By chance, the exclusive timepiece comes into his sights and is snapped up for little money. A few years later, all expectations were exceeded: The bargain turned into an expensive rarity. Success stories like this about watches that have not depreciated in value sometimes require a bit of luck as well as know-how. If you are aware of this, timelessly fascinating luxury watches remain an attractive option for investing savings wisely.

Watches as an investment? Interesting, if you can stay realistic

If you choose the right timepieces, you can invest in watches without losing value and achieve high increases in value. They are the insider tip when it comes to investments – especially in times of crisis. Immediately afterwards, a list reveals which models from Rolex, Omega, Breitling & Co are guaranteed to be and remain in demand. Such promises carved in stone are as serious as the prophecies of a fortune teller at the fair. This is evidenced by a number of vintage watches that were praised to the skies and bought for adventurous prices, only to be hit by a loss in value soon afterwards.

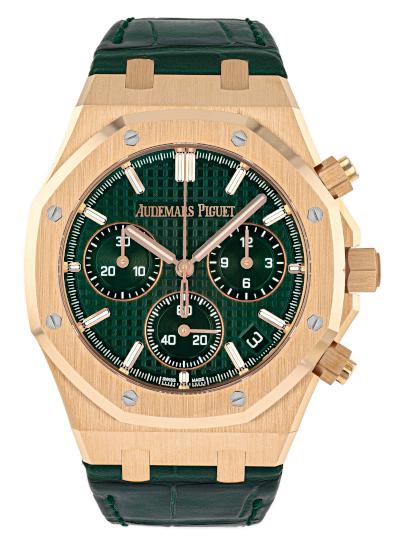

Anyone who concludes from these findings that it is not worth buying luxury watches is just as out of touch with reality as the exaggerated visions of the future held by self-important financial experts. Rather, it is about taking a rational look at what is meant by investing in watches without losing value. If individual preferences are combined with objective considerations when choosing a model, most masterpieces will meet expectations – regardless of whether they come from Audemars Piguet, Chopard, Junghans or another renowned manufacturer.

Works of art for moments of happiness that are priceless

The Queen of Naples longed for a piece of jewelry that would tell the time beautifully on her wrist. Abraham-Louis Breguet fulfilled her wish in 1810 with the first wristwatch. Since then, more than 200 years have passed in which technical achievements have been made. The smartphone provides constant access to time data based on high-precision atomic clocks. Nevertheless, luxury watches with hand-wound or automatic movements have lost none of their fascination. After all, they are works of art created by hand with remarkable finesse. Such observations indicate that manufacture watches retain their ability to inspire and will never be affected by a complete loss of value.

Anyone who hoards their savings in an interest-free bank account for decades will be disappointed in any case. In the case of timelessly sought-after wristwatches, on the other hand, the chances are good that inflation will have less of an impact on their tangible value in the long term than on the banknotes in your savings stocking. If no buyer is found for it later, this is at least to be expected: The price of new luxury watches has risen significantly due to increased material and labor costs and is an argument against purchasing them. Fortunately, there is a favorite piece in the safe that you can now proudly put on for special occasions. When that time comes, you’ve already bought the watches without losing value and gained a lot, haven’t you?

Dream watch with potential to increase in value

This kind of thinking suggests investing in watches that are bound to increase in value in an idealistic sense. Smart watch fans therefore direct their interest towards manufactories and collections that appeal to their hearts. This ensures that they will enjoy the masterpieces. Only after the groundbreaking decision has been made is it worth considering which models will retain their value. A look at tips from watch experts is inspiring if you don’t overestimate them. After all, any prediction regarding loss or increase in value remains speculative.

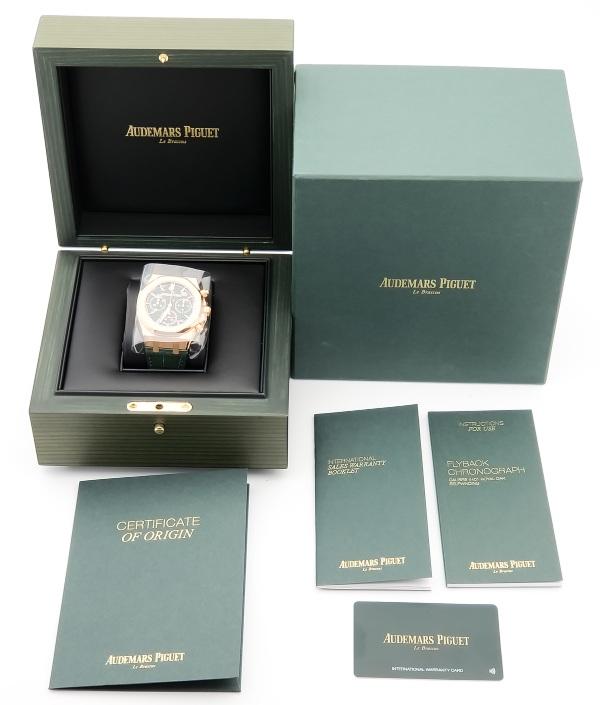

Experience shows this: A pioneer is ahead of its time, in low demand and comparatively inexpensive. Later, a change in taste draws interest to the underestimated model, which ideally comes into the limelight due to a spectacular event or a famous wearer. The Cosmograph Daytona sports watch from Rolex and the Royal Oak from Audemars Piguet are successful examples of increases in value that watch enthusiasts would hardly have expected decades ago. They also illustrate that the tide can turn when the hype dies down. This is particularly true for investors who suddenly have to sell due to a financial crisis and are unable to give investment watches the peace of mind they need for attractive performance.

Bold speculation or proven investment – a question of type and budget

Color, material, diameter – the yellow Spirit of Big Bang from Hublot with rubber strap and 45 mm case is a rebel on the luxury watch scene. Anyone who puts one of these in their safe will need courage. According to the recommended retail price, the eccentric automatic watch breaks the 100,000 euro barrier. Logically, the number of potential buyers who are able and willing to invest the impressive price plus inflation rate when reselling the watch is limited. The risk of a loss in value seems high. The opposite is conceivable: A financially strong watch fan dreams of a Hublot with a strictly limited edition. He is prepared to spend three times the original retail price.

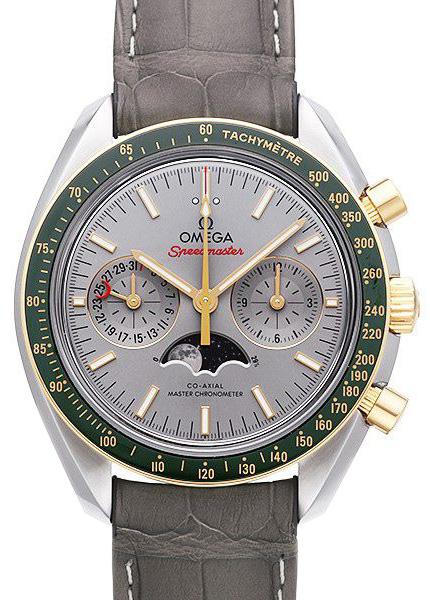

Those who cannot engage in such speculation tend to invest in tried and tested watches. The Omega Speedmaster has secured a permanent place in horological history because it was the first wristwatch on the moon. Humans will not stop exploring the universe. With every space mission that attracts media attention, it is inevitable that watch enthusiasts will remember the Moonwatch and want to treat themselves to a copy. This is why the Omega icon is considered to have a stable value and can be purchased in the classic version for around 5,000 euros or as an unusual edition for 50,000 euros, depending on your personal budget. Which model retains, loses or increases its value remains to be seen. In terms of adjusted profit, the classic model could win the race just as easily as the special edition.

Small investment, big impact – stylistically, ideally or financially

Max Bill was a creative all-rounder who was inspired by the Bauhaus era. The Weimar art school – founded by Walter Gropius – produced a design style that inspired at its debut, continues to inspire today and will probably never seem out of fashion. The award-winning Swiss designer’s most important works include dials that characterize a Junghans collection of the same name. The so-called architect’s watches are affordable compared to the timepieces of popular luxury brands such as Rolex, Chopard, Breguet or Breitling.

The artist’s birthday, the founding year of the Bauhaus school or key dates in watch history: many occasions in the coming decades can fuel the dream of owning an automatic watch in Bauhaus design. These occasions can be used to sell the watch without losing value. However, the chances are just as great that you will not want to part with the Black Forest design classic, which is and remains a style-conscious statement on the wrist regardless of the age. Can we give a guarantee for watches without loss of value? No, of course not. But you do get other guarantees with every watch at Uhrinstinkt. Such as authenticity and functionality.

Uhrinstinkt Magazine

Uhrinstinkt Magazine